In India, investing in a real estate sector is a daunting and intimidating affair altogether as there are cumbersome tasks involved before the real estate sale deed is made final and reaches its pinnacle. You have to go through an intricate verification process, legal-binding protocols and paperwork such as through the Dakhil Kharij certificate before you finally shift into your dream home

Further, what complicates the process is that the process of property transfer is dissimilar and varies as per different states

However, though the process is different in each state and whichever way the transfer takes place, ultimately it comes to the registration process that is followed by the process of mutation. To know more about Dakhil Kharij, keep scrolling through.

In a literal sense, if we want to understand what Dakhil Kharij is, then the process of recording the name of the purchaser after dismissing the name of the previous owner or the seller from a property is called Kharij Dakhil or Mutation Revenue record. In this process, the transfer of the property ownership from one person to another in the filling, rejection, or mutation of the revenue records occurs.

The process of transfer of the property ownership from one person to another in the filling, rejection, or mutation of the revenue records takes place. It is very important to get Dakhil Kharij because, without Kharij Dakhil, the buyer of the land cannot become the legal owner of the land. Only after the buyer obtains a Dakhil Kharij, he/she can legally become the owner of the property after the dismissal of the seller’s name from the revenue records. Online Dakhil Kharij is the procedure of keeping track of the name of the buyer after cancelling the name of the seller from a property.

Dakhil Kharij is also termed Mutation; it is the procedure where the ownership of the property is changed and recorded once the property is sold or transferred. And once it is completed, the name of the new owner is noted in the revenue records of the department of land revenue.

As per the preconceived notions, Mutation is not only a single time process. This has to be followed every time a transfer is made. Apart from that, it is suggested to do the mutation every 6 months to one year to make sure that no fraud transaction pertaining to the property is in effect.

This process can be completed in several ways. A few of them are listed below:

Purchase or Sale of Property – In case of a sale or purchase, the following documents are required- a copy of the sale deed that is registered, the latest tax clearance document, stamp paper bond, mutation application with stamp fee of court, etc.

Property Inheritance – This may occur via a will or intestate succession. The documents that will be required here are a death certificate copy of the previous owner along with the documents that establish the strong bond between the claimant and deceased, a will’s copy, a tax clearance file of the property, etc.

POA (Power of Attorney) – In such an event, the requisite documents for the mutation process are the power of the attorney papers, and associated affidavit in addition to an indemnity and documents proving tax clearance.

There are basically two types of mutation that takes place. Below are the types discussed in brief.

Agricultural land Mutation – In the case of agricultural land, the mutation has a bearing on the ownership of land in question. The ownership transfer will not be referred to as legal until and unless the mutation process has been completed properly and has been recorded within the revenue records.

In some cases, the government might acquire the property, and in such cases, compensation is given to the owner but only to those who have registered their names within the records.

Mutation of Non-agricultural land – In this case scenario, the land mutation doesn’t have any sort of bearing on the land ownership. Yet, it somehow affects the liability of the owner to pay municipal tax. Additionally, it might result in affecting the water as well as electricity supply.

The process starts by submitting the mutations’ application at the Tehsildar’s office along with a non-judicial stamp paper of the required fee. The documents mentioned above need to be submitted as per the type of mutation.

Once this is done, an anticipated date is asked for the proposed mutation, which is to be issued, stipulating the last date for the issuing of the Dakhil Kharij certificate.

Further, the statements of both parties are noted and verified to look for any discrepancies if they exist. If no problem or objection is found, the proposal of mutation is sanctioned.

On the off chance, any problem or discrepancy is found, the matter is then handed over to the Revenue Assistant of the area concerned, and the details of the problems are duly noted. If the parties are not satisfied with the order, an appeal can be filed before the Additional Collector within a month of the concerned order.

To do Dakhil Kharij (reject submission), one has to apply in his local revenue office or in Tehsil. When you have doubts, you can just type, ‘How to search for Dakhil Kharij online’, on google search, and you will find many links that will guide you to go through all the procedures easily.

In the application, the name and complete details of the landowner and the buyer should be written along with all of the data regarding the land, which include the amount of land, region, tehsil, etc. Some documents also are required to be connected with the application, such as – Sale Deed or draft of the Will, Transfer Duty Fee, Affidavit, etc.

After the dismissal of the filling, a notice is issued via way of means of the circle or tehsil, wherein it’s actually written that if any person has any objection on that property/land, then he can file a complaint within the circle or tehsil. If there’s any type of dispute on that land or on the filing of the objection via means of every person, the submitting of the dismissal is stopped until its decision, and if no objection is acquired, then the technique of dismissal is completed.

The process to apply for Dakhil Kharij online status differs from state to state. Here, the example of Uttar Pradesh is given to give you a rough idea of how to apply for Dakhil Kharij online.

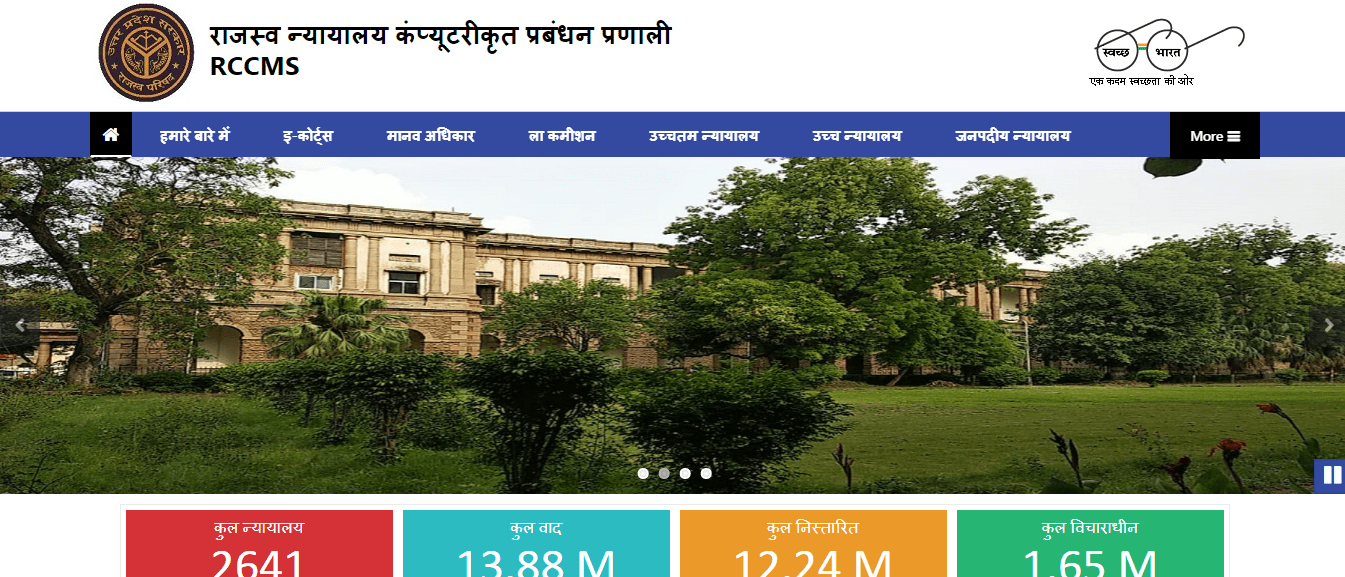

Step 1 – Visit vaad.up.nic.in website for determining the Dakhil Kharij online status of the application procedure.

Step 2 – Revenue Courts will open on the official page of the Computerized Management System of Uttar Pradesh.

Step 3 – Enter your mobile number where it is asked for.

Step 4 – You will receive an OTP, which you will have to enter in the given space.

Step 5 – Click on LOGIN.

Step 6 – Fill in the registry number and date and then hit the SUBMIT button.

Step 7 – Your details will pop up on the screen. Take a printout of the application detail. You can also get the online dakhil kharij form with the same process by visiting the official website of the respective state that you want to apply for.

Registration is the process of getting the legal ownership of land or property in the name of the buyer. On the other hand, mutation is the process that follows registration. A land mutation means that the registration is duly recorded in the revenue records of the government. Mutation entries are only needed for revenue purposes to ensure that the taxes and revenues associated with the land are paid regularly without any delay or default.

Also Read: View Tamilnadu Land Records Online and see Patta vs Chitta

At the time of the sale of property or any land, the buyer or the purchaser might ask for the Dakhil Kharij Certificate. This is nothing but the mutation certificate where it determines the ownership of the property or land of the owner. It is a certificate that has the details of the owner and about the ownership of the land or the property. This online Dakhil Kharij certificate is an important document that is needed during the time of buying or selling or at times when one needs to apply for a loan for the same.

To download the Dakhil Kharij certificate online, follow the steps given below. You can also check dakhil kharij online status with the same procedure side-by-side.

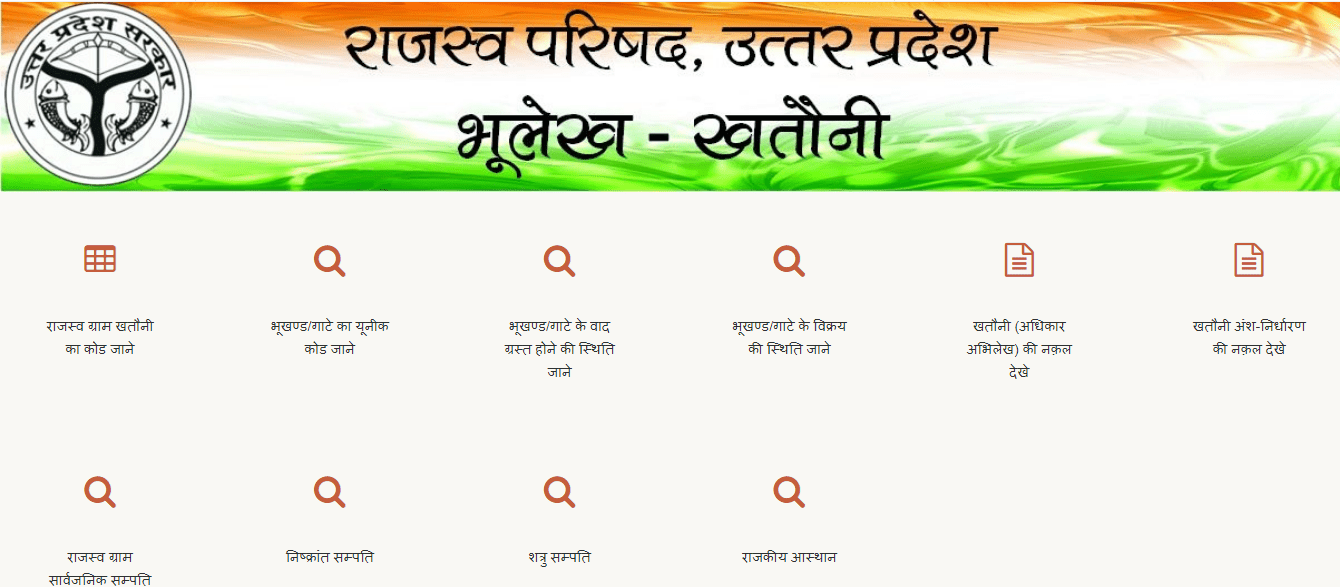

Step 1 – Visit the official website of UP Gov. upbhulekh.gov.in, where you have to view the copy of your khatauni. Here you will find online dakhil kharij status through the dakhil kharij online login.

Step 2 – After this, a captcha will appear. Further, after entering captcha, you will be given four options to choose from as to how you want to search.

Step 3 – Click on view quotation, after which you will get another captcha to enter.

Step 4 – Enter the captcha, and all the details of the land will appear.

Step 5 – Click on the Khasra no.

Step 6 – A new page will open with three options

Step 7 – Click on the option of ‘know the status of being litigated.’

Step 8 – A new page will open in front of you.

Step 9 – Click view details, and the details would be visible on the screen. There will also be an option of the view order form where you’ll get the option of checking the online status of dakhil kharij, and then you can try downloading your copy of Dakhil Kharij. This way, an online dakhil kharij status check becomes easy for everyone.

So, it can be concluded in this article that checking online Dakhil Kharij status or mutation is very important for proving the ownership of the property. It refers to the process of recording the name of the current owner or the purchaser of the property by cancelling the name of the previous owner. And to make it easier, the government has given the opportunity to apply and obtain a Dakhil Kharij online without paying visits to the local land revenue office again and again. This will also help to check dakhil kharij status online.

Once the purchaser has completed the property purchase process, which incorporates signing the sale deed, the purchaser has to replace the statistics in the land revenue branch of the authorities. “Dakhil Kharij”, as it is called in Hindi, is the method of switching of identity possession from one party to any other while the stated asset is bought or transferred. It must be performed in all of the instances of asset transfers consisting of sale or buy of asset, the demise of property’s owner, inheritance, gifts, and purchases made via Power of Attorney. After the process of mutation is done, the asset is subsequently registered in the name of the owner in the authority’s revenue. This allows the authorities to value property tax, which varies from state to state.

First and foremost, visit vaad.up.nic.in Dakhil Kharij online application portal. Next, the Revenue Courts Computerized Management System of Uttar Pradesh will open on the official page. Now, enter your mobile number. You will receive an OTP. Enter the OTP. Click on the LOGIN option. Subsequently, fill in the registry number and date. Hit Submit option. At last, your details will pop up on the screen. Take a printout of the application detail.

It is said to take 15 to 30 days for the entire filing procedure to complete.

We need to file an appeal within 30 days of the order of rejection.

Submit an application form to the regional municipal corporation with details of the proprietors along with private information, property information along with address, registration date, sort of property, type of transfer.

Along with the application form, the following files that are needed to be submitted are: Copy of sale deed, an affidavit on stamp papers, indemnity bond, copy of Aadhaar card, property tax receipts and copy of will/succession certificates/loss of life certificates (in case of inheritance). Once all of the required files are submitted, the local revenue inspector will check the files and can verify the property and then, the application will be processed. The procedure takes 15 days to a month, and then a mutation certificate is issued. The local civic corporation may also value a nominal rate of ₹25 to ₹100 depending as per state.

Exploring Options for Buying or Renting Property

Try Now

MORE FROM CATEGORY